Healthcare Stock Ready For Fresh Highs In 2021

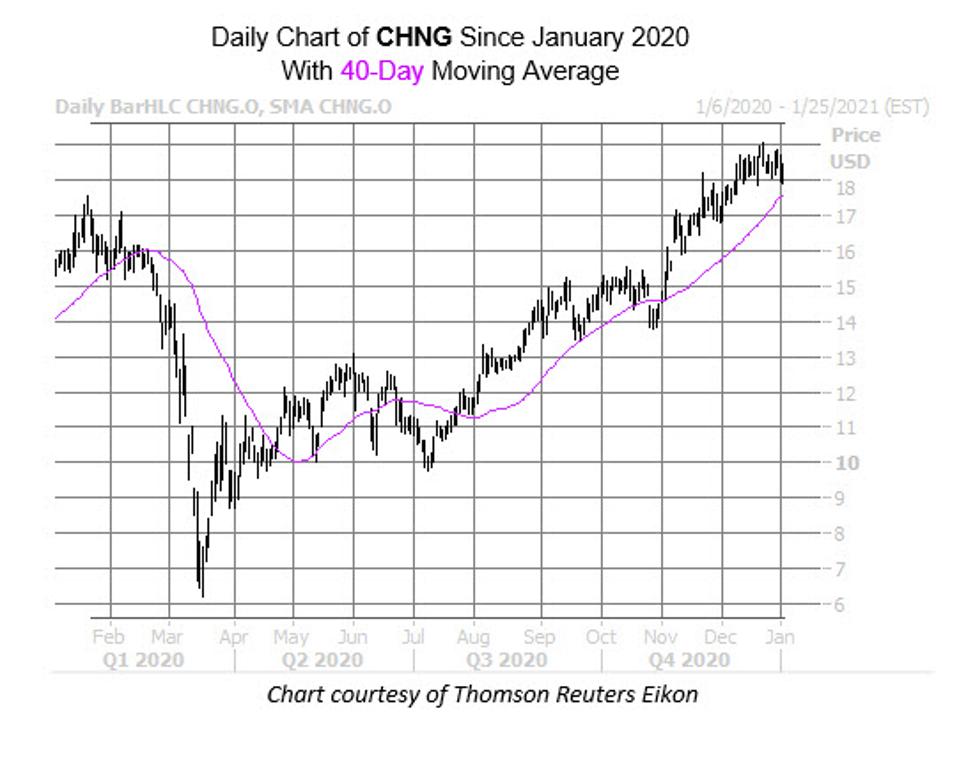

Tech platform Change Healthcare (CHNG) enjoyed a sizable rally during the second half of 2020, steadily chugging past its pre-pandemic peak in mid-November to notch a Dec. 23 all-time-high of $19.08. Since then, the stock seems to have plateaued, with the $19 mark moving in as a ceiling in recent weeks. However, a pullback to a historically bullish trendline could keep some wind at the equity’s back, and even push it past this resistance level to register even more record highs in 2021.

According to a study from Schaeffer’s Senior Quantitative Analyst Rocky White, CHNG just came within one standard deviation of its 40-day moving average, following a lengthy period above the trendline. White’s data shows two similar pullbacks in the past three years yielding positive returns. In fact, one month after these signals, CHNG averaged a 9.1% return. From its current perch, a similar move would put the equity at a fresh record high of $19.90.

Despite CHNG’s recent rally, shorts have been building their positions, with short interest up 10.8% in the last reporting period. The 12.24 million shares sold short now account for 9.8% of the stock’s available float, and would take over a week to cover at its average daily pace of trading. Should some of these bears begin to change their tune, a short squeeze could put additional tailwinds at the security’s back.

Now looks like an opportune time to speculate on CHNG’s next move with options, too. The is per the security’s Schaeffer’s Volatility Index (SVI) of 43%, which stands higher than only 5% of readings from the past year. This means options players have been pricing in relatively low volatility expectations at the moment. In other words, options on Change Healthcare stock are affordably priced.