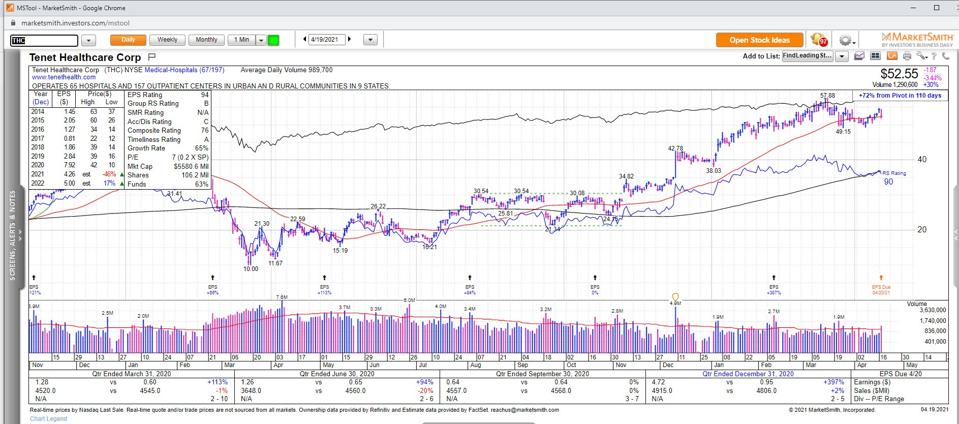

Earnings Preview: What To Expect From Tenet Healthcare On Tuesday

Tenet Healthcare Corporation is scheduled to report earnings after Tuesday’s close. The stock hit a record high of $210/share in 2002 and is currently trading near $52/share. The stock is prone to big moves after reporting earnings and can easily gap up if the numbers are strong. Conversely, if the numbers disappoint, the stock can easily gap down. To help you prepare, here is what the Street is expecting:

Earnings Preview:

The company is expected to report a gain of $0.80/share on $4.76 billion in revenue. Meanwhile, the so-called Whisper number is a gain of $0.92/share. The Whisper number is the Street's unofficial view on earnings.

A Closer Look At The Fundamentals:

The stock is considered “under-valued” because the P/E ratio is only 7, which is sharply lower than the broader market and many other healthcare stocks. Earnings have grown nicely over the past year. In fact, in Q4 2020, earnings vaulted by a very impressive +397% compared to Q4 2019. Meanwhile, sales grew by +2% during the same period. In fact, earnings have grown in 3 of the past 4 quarters and the stock is trading just below a new 52-week high which is a very welcomed sign considering the P/E ratio is only 7!

Closer Look At The Technicals:

Technically, the stock is acting very strong as it remains perched below a 52-week high. The stock has enjoyed a huge run over the past 12 months and sports a very healthy relative strength rating of 90 (99 is the highest), which means that it is outperforming the market and most of its peers.

Data and Charts Courtesy of MarketSmith Incorporated