What’s Next For Molina Healthcare Stock?

The stock price of Molina Healthcare (NYSE: MOH), a managed care company best known for its health insurance through Medicaid and Medicare, has seen an 8% rise over the last ten trading days, while it’s up 4% over the last five trading days, and we believe the stock may continue to trend higher in the near term. The recent rise can largely be attributed to an overall growth seen in healthcare stocks, including Molina, Centene, and Humana, among others. Healthcare stocks have been in focus this year with expectations of increased investments into the healthcare system under the new government administration. Healthcare stocks focused on government sponsored healthcare plans stand to benefit from increased investments. Furthermore, Molina last week announced that it has won a contract to provide medical care coverage to Medicaid beneficiaries in Ohio, aiding its stock price growth.

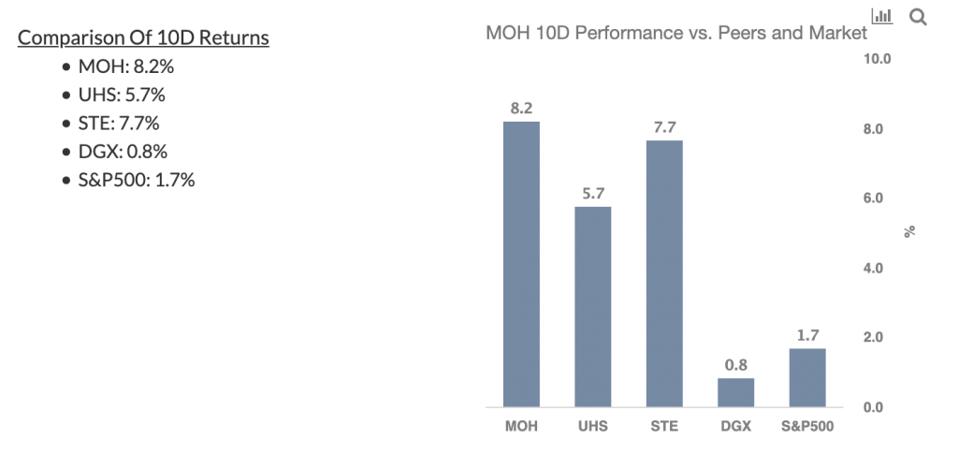

Looking at the recent rally, the 8% rise for MOH stock over the last ten days compares with just 1.7% gains seen in the broader S&P 500 index. Now, is MOH stock poised to gain further? It appears so. Given the current momentum in the healthcare stocks, and based on our machine learning analysis of trends in the stock price over the last few years, we believe that there are higher chances of a rise in MOH stock over the next month (twenty-one trading days). See our analysis on Molina Healthcare Stock Chances of Rise for more details. Curious about the possibility of rising over the next quarter? Check out the MOH Stock AI Dashboard: Chances Of Rise And Fall for a variety of scenarios on how MOH stock could move.

Five Days: MOH 4.1%, vs. S&P500 -0.01%; Outperformed market

(20% likelihood event)

- Molina Healthcare stock rose 4.1% over a five-day trading period ending 4/20/2021, compared to a broader market (S&P500) decline of 0.01%

- A change of 4.1% or more over five trading days is a 20% likelihood event, which has occurred 515 times out of 2516 in the last ten years.

Ten Days: MOH 8.2%, vs. S&P500 1.7%; Outperformed market

(15% likelihood event)

- Molina Healthcare stock rose 8.2% over the last ten trading days (two weeks), compared to broader market (S&P500) rise of 1.7%

- A change of 8.2% or more over 10 trading days is a 15% likelihood event, which has occurred 378 times out of 2511 in the last ten years.

While MOH stock may gain more, 2020 has created many pricing discontinuities which can offer attractive trading opportunities. For example, you’ll be surprised how counter-intuitive the stock valuation is for UnitedHealth vs Ingevity.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams