Healthtech Acquisition Worth $16 Million Signals Shift In Clinician-Patient Communication

In June 2020, Induction Healthcare, the group behind the Induction and MicroGuide apps acquired fellow healthtech company Zesty, which enables integration between a hospital’s electronic patient record (EPR) and patient administration system (PAS) in a deal worth £12.7 million ($16M).

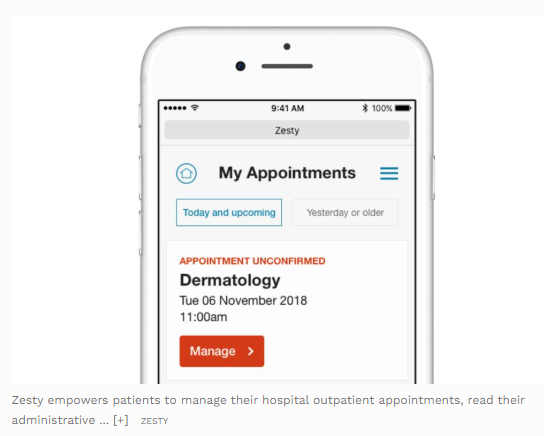

Induction, used by over 119,000 clinicians in the U.K., boosts clinicians' productivity, enhances communication and has seen an almost 500% increase in usage during the Covid-19 crisis. On the other side, Zesty empowers patients to manage their hospital outpatient appointments, read their administrative and clinical correspondence, attend a video based consultation and store a personal copy of their records.

Bringing together Zesty and Induction Healthcare’s technologies, the group will now be one of the first technology platforms to connect patients, clinicians and healthcare information across both multiple hospital sites and EPR platforms, which could represent a significant paradigm shift in clinician-to-patient communication.

Dr Hugo Stephenson, CEO of Induction, said:

“Zesty has solved the problem of integrating with different electronic patient record systems. Connecting the most used app by NHS doctors (Induction) and the most used app by NHS trusts (MicroGuide) with patients and their health records, has the potential to deliver the right resources to the right places at the right time - a transformational opportunity for healthcare.”

James Balmain, CEO of Zesty, said:

“I see the frustration that clinical teams and patients feel every day. Basic things, like updating a patient record or booking an appointment - are just not easy enough. So an app for doctors, connected to an app for patients makes total sense. Induction and Zesty coming together can help improve the way healthcare is delivered.”

A better way to communicate?

Communication between clinicians, patients and administrators has been a longstanding challenge, and many healthtech companies are trying to modernise existing, inefficient systems of letters, written notes and bleeps (pagers).

Speaking to Balmain, he was keen to emphasise the potential of the new collaborative approach when it comes to clinician-to-patient communication:

“We want to form a single communication channel right through from patient to clinician and administration, which provides a huge opportunity for speeding up so much of healthcare, making it more efficient, dropping the costs and making healthcare more sustainable.”

Balmain went on to talk about his vision of asynchronous communication between patients and clinicians: instead of patients having designated time with clinicians and the amount of ‘healthcare’ being fixed by time (synchronous), a flexible communication channel could now be opened from the clinician to the patient, via an EPR, so communication could be ad-hoc and documented in their notes, i.e. asynchronous.

In practical terms, it’s the difference between giving each of your friends 30 minutes per day to speak to you in person versus replying to them as and when, remotely on Whatsapp. Balmain sees the latter being used in healthcare to increase efficiency. And in the context of Covid-19, where backlogs mean healthcare providers are encouraged to look for ways to increase efficiency, one might expect new healthcare systems that include asynchronous communication to be favorable.

Usurping the usual barriers

It will be interesting to watch the next move from Induction Healthcare Group following this acquisition. Their Induction app securely shares useful information for clinicians and their MicroGuide app is a platform for clinician guidelines, supporting the likes of Barts Health NHS Trust in the Nightingale London project with antimicrobial and COVID-19 content. Seemingly very simple functionality in both cases. But their utility means Induction is the pocket of most clinicians in the U.K. and Microguide is used across approximately 75% of NHS trusts.

Any app now bolted onto Induction Healthcare Group’s platform is a thumb’s width away from being used by 119,000 clinicians and/or 75% of NHS Trusts. In a sector where adoption of technology is what most-often claims companies in the so-called ‘valley of death’ between initial funding and product-market fit, this access to clinicians and NHS Trusts could prove very valuable.